Careerlink has a strong commitment to complying with laws and regulations and conducting business activities in a sound and transparent manner. To serve as guidelines for corporate ethics, we have established a corporate philosophy and a code of conduct that is to be observed by directors, executive officers and employees. These guidelines are the foundation for all corporate governance activities.

We attache importance to corporate governance in order to promote soundness, transparency, and efficiency of management, to earn the trust of shareholders, business partners, working staff, employees, and society, and to become a company that meets the interests of all stakeholders and develops sustainably into the future.

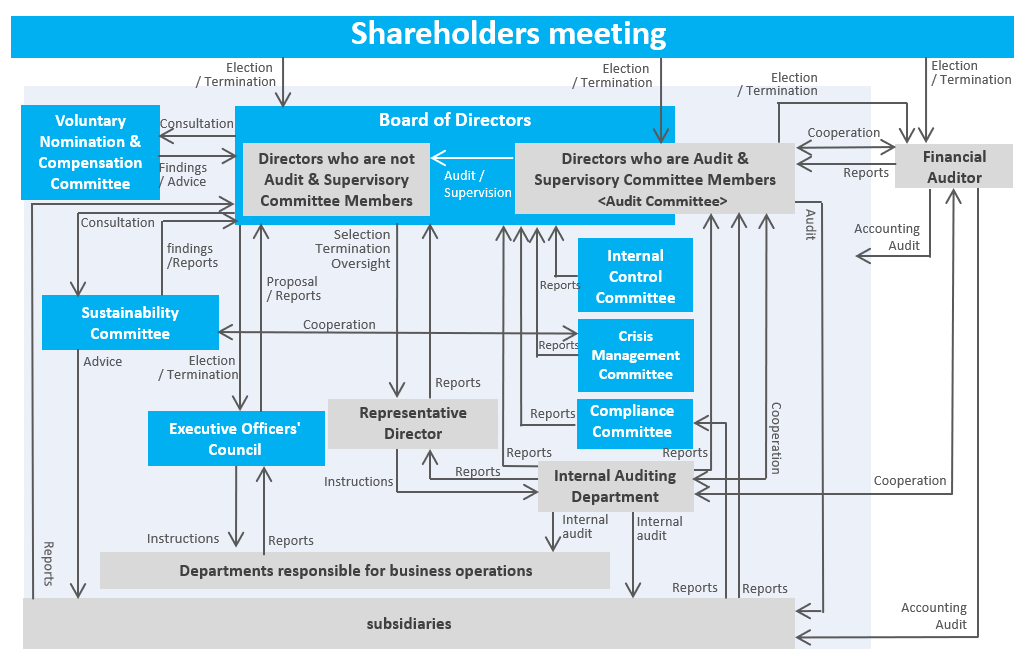

In light of the importance of corporate governance in corporate management, the Company holds regular monthly meetings of the Board of Directors, the Executive Officers' Committee, the Internal Control Promotion Committee, and the Compliance Committee to strengthen the corporate governance system.

Organizational composition and operation

| Organizational structure |

Company with Audit and Supervisory Committee |

| Authorized number of directors |

14 |

| Term of directors |

1 year(2 years for Audit and Supervisory Committee Members) |

| Chair of the board of directors |

President of Careerlink |

| Number of directors |

9 |

| Outside directors |

Yes |

| Number of outside directors |

3 |

| Outside directors who are independent directors |

3 |

Standard for the autonomy of independent outside directors

The Careerlink Board of Directors believes that the independence standards set forth by the Tokyo Stock Exchange, Inc. are appropriate, and selects as candidates for independent outside directors those individuals who can be expected to contribute to candid, active, and constructive discussions at the Board of Directors meetings, based on the basic idea that there is no risk of a conflict of interest with general shareholders. The three independent outside directors do not have any personal, capital, business, or other interests in the Company that might cause a conflict of interest with general shareholders, and furthermore, they are not from a major business partner or major shareholder, there is no risk of a conflict of interest with general shareholders.

Attendance and participation (FY3/2025)

Satoko Kitamura,

Corporate Auditor |

Ms. Kitamura attended all 16 Board of Directors meetings held during this fiscal year. Based on my professional expertise as a lawyer and my deep understanding of corporate legal affairs, I provided necessary opinions as appropriate from the perspective of ensuring that the execution of duties by directors (excluding Audit and Supervisory Committee members) and the decision-making process of the Board of Directors resolutions were appropriate. Additionally, as a member of the Nomination and Compensation Committee, I attended all committee meetings held during this fiscal year, fulfilling a supervisory role from an objective and neutral standpoint. |

Kesao Endo,

Corporate Auditor |

Mr. Endo attended all 16 Board of Directors meetings and all 13 Audit and Supervisory Committee meetings held during this fiscal year. Drawing primarily on my expertise as a certified public accountant and tax accountant, I provided necessary opinions as appropriate from the perspective of ensuring that the execution of duties by directors (excluding Audit and Supervisory Committee members) and the decision-making process of the Board of Directors resolutions were appropriate. Additionally, as a member of the Nomination and Compensation Committee, I attended all committee meetings held during this fiscal year, fulfilling a supervisory role from an objective and neutral standpoint. |

Iwao Hasegawa,

Corporate Auditor |

Mr. Hasegawa attended 13 out of the 16 Board of Directors meetings and 11 out of the 13 Audit and Supervisory Committee meetings held during this fiscal year. Based on my extensive career experience and broad insights, I provided necessary opinions as appropriate from the perspective of ensuring that the execution of duties by directors (excluding Audit and Supervisory Committee members) and the decision-making process of the Board of Directors resolutions were appropriate. Additionally, as a member of the Nomination and Compensation Committee, I attended all committee meetings held during this fiscal year, fulfilling a supervisory role from an objective and neutral standpoint. |

Training for directors and corporate auditors

To give newly elected directors and corporate auditors the knowledge they need, these individuals receive lectures from executives in charge of each business unit concerning description of the Group's business, management policy, management strategy, and operations of each department within the Company. In addition, all directors attend external seminars and other events about relevant topics. By providing these opportunities and covering the expenses, Careerlink helps directors perform their duties properly.

Independent auditor

Careerlink has an auditing contract with KPMG AZSA LLC. There is no relationship involving financial interests between Careerlink and Asuza Auditors or with the employees of this company who perform audits of Careerlink.

The certified public accounts at KPMG AZSA who are the engagement partners for Careerlink’s financial statements and notes are Mr. Kuwamoto and Mr. Shinbo. In addition to the 2 engagement partners, 5 certified public accounts and 10 others at KPMG AZSA are involved with Careerlink audits. KPMG AZSA also has voluntary regulations that limit the length of involvement with the audits of a single company.

The Audit and Supervisory Committee members and the Audit and Supervisory Committee shall make sure that the accounting auditor has the status of execution of duties, independence and necessary expertise, that the audit system is in place, and that the audit plan is rational and appropriate. After confirming and based on the audit results so far, we comprehensively evaluate the accounting auditor.

Policies and procedures for the board of directors in determining executive management and director's compensation

a. Basic policyCareerlink's basic policy is that the compensation of the Company's Directors should motivate them to pursue and realize the Group's corporate philosophy (the joy of work for all) and contribute to the Group's sustainable development and medium- to long-term improvement of corporate value, to contribute to the achievement of the Group's performance targets, to increase their awareness of management from a shareholder perspective, and that the process of determining their compensation should be fair, objective and transparent.

The Company sets the level of compensation for Directors at a competitive level that contributes to securing excellent management personnel, taking into consideration the Company's management environment, the position and responsibility of each Director, and his/her contribution to the Company's business performance, with reference to the level at other companies in the same industry (personnel service industry) and listed companies of the same size as the Company based on an external database on executive compensation. The compensation of Directors (excluding Directors who are members of the Audit and Supervisory Committee and Outside Directors) is set at a competitive level that contributes to securing excellent management personnel and consists of monetary compensation and non-monetary stock-based compensation in order to function as a sound incentive for sustainable growth and a compensation system that is linked to shareholder returns. Monetary compensation consists of fixed compensation and performance-linked bonuses, while non-monetary compensation in the form of stock options has been introduced.

In addition, compensation for directors who are members of the Audit and Supervisory Committee and outside directors consists solely of fixed compensation among monetary compensation.

b. Policy on determination of individual amounts of monetary compensation

Fixed compensation for Directors (excluding Directors who are members of the Audit and Supervisory Committee and Outside Directors) is determined in consideration of the position and responsibility of each Director and his/her contribution to the Company's performance, and is paid monthly. For Bonuses which are performance-linked compensation to Directors (excluding Directors who are members of the Audit and Supervisory Committee and Outside Directors) ,Careerlink has adopted "net income attributable to shareholders of the parent company," which represents the final results of management activities and is directly related to the improvement of corporate value, as a performance indicator. The target for achieving this performance is the forecast of "net income attributable to shareholders of the parent company" for the relevant fiscal year, as stated in the financial results for the previous fiscal year, which is announced at the beginning of the fiscal year.

c. Policy for determining the nature and amount or number of non-monetary compensation

Careerlink has introduced a stock option plan, which is stock-linked compensation, as non-monetary compensation for directors (excluding directors who are members of the Audit and Supervisory Committee and outside directors). The amount of compensation is determined by taking into consideration the promotion of the Company's corporate philosophy and management policies, human resource development, contribution to work style reforms, and other factors from the viewpoint of raising management awareness from the shareholders' perspective and reflecting performance results over the medium to long term.

d. Policy on the process for determining the amount of compensation by individual for monetary and non-monetary stock compensation

Directors (excluding those who are members of the Audit and Supervisory Committee) Monetary compensation, which is the sum of fixed f remuneration and bonuses as performance-linked remuneration,compensation and bonuses, is within the maximum amount of compensation resolved at the General Meeting of Shareholders. Fixed compensation is determined with reference to the compensation levels of other companies in the same industry as the Company and listed companies of the same size, taking into consideration the Company's management environment, the position and responsibilities of each Director, and his/her contribution to the Company's performance. Bonuses, which are performance-linked compensation, are paid only when the Company achieves its performance target of net income attributable to shareholders of the parent company for the fiscal year under review. The amount of compensation for individual directors is determined by the Board of Directors.

The amount of stock-based compensation, which is non-monetary compensation, is determined within the amount of compensation resolved at the General Meeting of Shareholders, in accordance with the internal regulation "Stock Compensation-Type Stock Options for Directors," after consultation and report to the Nomination and Compensation Committee, the majority of which are independent outside directors, and after deliberation by the Board of Directors. The Board of Directors determines the amount of stock-based compensation to be allocated to individual directors.

Monetary compensation for directors who are members of the Audit and Supervisory Committee is determined through discussions among the directors who are members of the Audit and Supervisory Committee within the amount of compensation resolved at the General Meeting of Shareholders.

Supplementary information

Compensation of Directors and Audit and supervisory committee members for the fiscal year that ended in March 2025 was as follows.

Directors (six):¥140,960 thousand (including outside director(one): ¥6,504 thousand)

Audit and supervisory committee members (three): ¥22,512 thousand (including outside director(two): ¥13,008 thousand)

The amount of compensation for directors does not include salaries for employees who also serve as employees.

Cross-shareholdings

Careerlink's policy for cross-shareholdings is to contribute to the enhancement of the Company's corporate value through the holding of shares of counterparties with which the Company has cooperative relationships in relation to the Company's business activities. In addition, with respect to the exercise of voting rights pertaining to shares held under the policy, from the perspective of preventing damage to shareholder value and increasing shareholder value, the Board of Directors of the Company examines each proposal at the General Meeting of Shareholders each year. For example, the Board of Directors will decide whether to approve proposals for the election and dismissal of directors, favorable issuance of new shares, stock acquisition rights, mergers, acquisitions, and transfers of business or not. With regard to shares held under the policy, the Board of Directors will annually review the medium- to long-term economic rationale and future prospects based on the company's business performance, the existence of scandals, and the return on such shares, and decide whether to continue to hold or sell such shares.

Constructive discussions with Shareholders

As one way to contribute to sustained growth and a steady long-term increase in corporate value, Careerlink has an investor relations program, headed by the director of the Corporate Planning Division, that includes holding discussions with shareholders when requested as much as possible. Furthermore, Careerlink holds information meetings for securities analysts and institutional investors in May and Novenber for first half and fiscal year results of operations. There are also several information meetings for individual investors each year. In addition, the Careerlink website (https://www. careerlink.co.jp/)

includes the most recent quarterly and fiscal year financial data as well as recent financial and business reports and other information for investors.

Accessible shareholders' meetings

|

Additional Note |

| Earlier dispatch of proxy materials |

Notices for the shareholders meeting held on June 26, 2025 were send on June 5, which was 3 weeks prior to the meeting date. |

| Staggering of days of shareholders meeting |

Careerlink exercises care to hold its shareholders meeting on a day when there not many other shareholders meetings so that as many shareholders as possible can attend. |

| Others |

Careerlink posts the notice of convocation of shareholders meeting

on its website for the convenience of shareholders. |

Basic Sustainability Policy

CareerLink believes that it is important to address various issues from an ESG perspective in order to pursue our corporate philosophy of "Bringing joy to everyone at work." We will realize our growth and contribute to the realization of a sustainable society by expanding employment, providing opportunities to work in various occupations and various time zones, actively working on diversity and inclusion, strengthening corporate governance and risk resilience, and taking multifaceted initiatives to address environmental issues such as climate change.

Internal reporting system

Careerlink has an internal reporting system that allows employees and others to report illegal or inappropriate behavior and information disclosures and suspicious activities. There is no risk of any negative consequences for individuals who submit reports. Information and allegations received through this system undergo an objective examination and are used in an appropriate manner. The board of directors is responsible for establishing and supervising the operation of this internal reporting system.